Many traders have been fascinated with Bitcoins since the very first time they heard about digital currency. If you think Bitcoin trading is not for you, you might be wrong! The world of Bitcoin trading is highly exciting and can yield high profits if you know what you are doing.

However, it also has its share of risks and dangers. If you are new to the world of Bitcoin trading, read more to learn more about the different Bitcoin trading strategies that you can adopt to start trading Bitcoins.

How to Trade Bitcoin?

Some of the strategies that you should consider when trading Bitcoins include market timing, hedging, and arbitrage. Market timing will help you gauge when to buy or sell Bitcoins based on what is happening in the market.

Hedging will help protect your Bitcoin position in case the price goes down by buying coins at a lower price and selling them as they increase in value. Arbitrage is one of the most effective strategies because it involves buying low and selling high.

The cryptocurrency world has seen a lot of changes over the last few years with more people jumping aboard to trade digital currencies like Bitcoin. If you are new to this world, know that a lot is going on and many things can happen while you’re trying to figure out how best to trade Bitcoins!

So, whether you’re looking for a simple investment strategy with little risk or want to jump into the hype around Cryptocurrencies, understanding how to trade Bitcoins might be an interesting endeavor for you!

What are Bitcoin Trading Strategies?

Bitcoin trading strategies are a set of rules that traders use to generate profits. These strategies often come in the form of technical analysis and/or fundamental analysis.

Bitcoin trading strategies are typically used by people who are new to Cryptocurrencies. Both these types of investors have different methods for generating income, so it’s important to find the one that works best for you.

What Are the Different Types of Bitcoin Trading Strategies?

There are many different strategies you can use when trading Bitcoins. The two most popular types of strategies for Bitcoin trading are scalping and long-term trading.

Scalping is one of the fastest and easiest ways to gain huge profits in a short amount of time. This type of strategy involves taking advantage of the rapidly changing price levels on Bitcoins. You would buy low, sell high, and make money while you sleep (or work).

The other type is long-term trading. With this type of strategy, you buy Bitcoins at a low point and trade them throughout the year until they have appreciated significantly in value.

There is no quick way to make money with this strategy since it takes time for your investment to grow in value. However, once you have acquired Bitcoins in this fashion, they will always be worth more than when you originally acquired them.

Bitcoin Technical Analysis and Trading Strategies

Many traders use technical analysis to trade Bitcoins. This is because it’s fairly easy to confirm the price of Bitcoins through charts. Many traders use trading strategies like the one-day, one-week, and three-day close trend lines. The trend lines help in determining whether a trader should buy or sell on any given day.

The list of strategies can go on and on and you should try out as many of them as possible to find out which strategy helps you make quick profits without costing too much money.

Introduction to Bitcoin Trading Strategies

The world of Bitcoin trading can be highly exciting and rewarding if you know how to do it properly. If you are new to Bitcoin trading, keep reading so that you can learn about the different Bitcoin trading strategies that people use for making quick profits without costing too much money.

How to Use Bitcoin Trading Strategies?

Here are some of the best Bitcoin trading strategies that you can adopt.

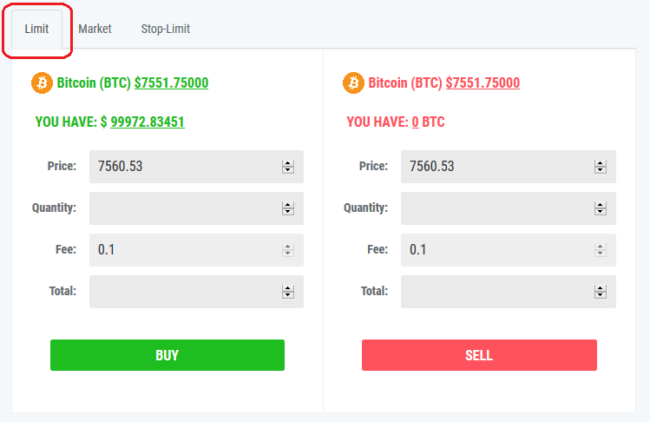

1. Set a price limit

This is one of the most common Bitcoin trading strategies. The idea is to set an upper limit for your Bitcoins and then buy or sell when it falls below that price. For example, if you think the price will rise in five days and you want to be sure to make a profit from your investment, set a lower limit for yourself. When the price increases to the value you’ve decided on, you’ll be able to make a quick profit.

2. Buy low, sell high

The strategy here is to buy low and sell high by using this as your entry point into the market and exiting at higher profits. It can also be used with short or long-term investments. In this strategy, you will have many chances to make money instead of just one when doing day trading with Bitcoins or other Cryptocurrencies like Ethereum or Ripple.

3. Day trading

Day trading is also known as scalping because it involves setting up positions in just a few hours and closing them down just as quickly before they become unprofitable due to increased volatility in prices of Cryptocurrencies over time. This Bitcoin trading strategy is considered risky but rewarding if done right!

4. Swing trading

This type of Bitcoin strategy entails buying Cryptocurrencies when they are falling and selling them when they are rising in value for profit potentials over time.

Advantages of Bitcoin Trading Strategies

The main advantage of Bitcoin trading strategies is freedom. There are no intermediaries to restrict your investment choices or to limit your funds. This means that you can use Bitcoin trading strategies to invest in what you want and how much you want to invest.

This also means that if digital currencies ever become illegal, you will still be able to trade them without any red tape. This is not the case with other types of investments.

Bitcoin trading strategies also allow investors to choose their risk tolerance levels. In other words, you can decide how much risk for how much return suits your needs best. This allows for a more personalized experience.

Bitcoin trading strategies also offer an opportunity for people who don’t have the time or expertise needed to develop a thorough investment strategy on their own. With Bitcoin trading strategies, you have access to experienced professionals who have been through the process before and know what they’re doing.

The pros can help guide you through this process so that you don’t make mistakes and give up too soon on investing in Cryptocurrencies or Bitcoin specifically.

Conclusion

Trading is a high-risk endeavor with both potential benefits and potential losses. Any trader needs to understand their investment level and be able to have the appropriate expectations when it comes to trading.