If you are new to the world of stock investing and are seeking for the finest stock trading application, it can be difficult to know where to begin. Here are some suggestions to get you started. When selecting a mobile application, it is critical to ensure that it is suitable with your specific investment objectives.

Ultimately, the purpose of this post is to provide you with the most up-to-date information about the best stock trading applications now accessible in 2024 that should be excellent for your financial requirements.

1. OBRinvest

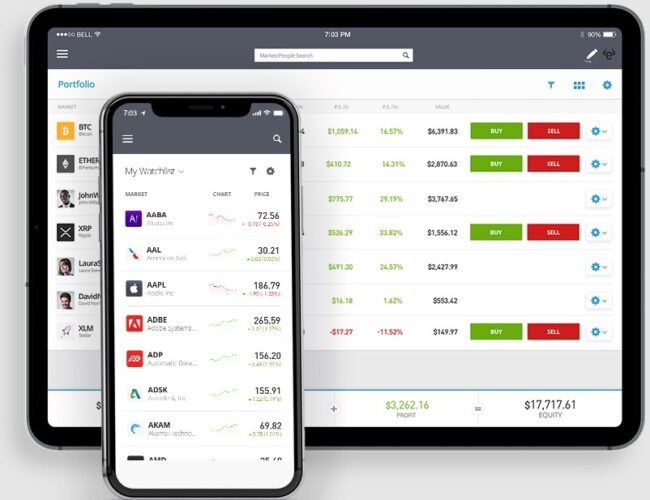

OBRinvest provides a one-of-a-kind web-based contract for difference trading platform. Their trading software is user-friendly and simple to use, making it suitable for investors of all experience levels. Just go to OBRInvest.com and create a free account. For more experienced day traders and investors, the popular MT4 trading platforms, as well as the traditional mobile trading applications for Android and iOS, are available for download.

According to the European Union Mifid mandate, more than 300 underlying assets are accessible for trading, with leverage rates as high as 30:1 available. There are CFDs on currency/forex pairs, cryptocurrency, US stocks & European stocks (with dividends), market indexes, and commodities to trade, as will be evident to investors.

Due to the fact that they are global brokerage business, their website is available in a variety of languages including English, Italian, German, Spanish, and Dutch, among others. You have the option of having your trading account denominated in any of the following currencies: USD, CHF, EUR, and GBP.

2. eToro

eToro is a social trading platform where you can trade stocks commission-free via their app that can be installed on devices running on Android or iOS mobile operating systems. What’s interesting about eToro is that it has a copy trading feature wherein you can easily replicate the positions of other experienced traders so when their investments make a profit then you make a profit as well. More information about this broker and its features can be found at Wikitoro, a dedicated online wiki for eToro traders.

3. Fidelity

Fidelity provides an extremely unusual mix of cheap fees and great features, making it an excellent choice for investors of any experience level. Take a look at how many of the finest stock trading applications are offering zero commissions and presume they are all priced the same way. However, you would be hard pushed to find a self-directed investment platform that offers higher overall rates than Fidelity Investments.

Fidelity claims that it does not benefit from the sale of your purchase or sale orders to third-party firms. As a result, consumers benefit from the most competitive pricing on order execution. Fidelity provides a large number of mutual funds with zero cost ratios, and more than 3,400 of them are free of transaction expenses.

However, despite its rock-bottom rates, Fidelity offers what is probably the most comprehensive research material of any stock trading and investment software available. On its website, you may access stock reports from more than a dozen different third-party research companies. Fidelity Viewpoints, the company’s in-house market study service, has also received positive feedback. Then there’s the simple, comprehensive stock screener with a bevy of alternatives to consider.

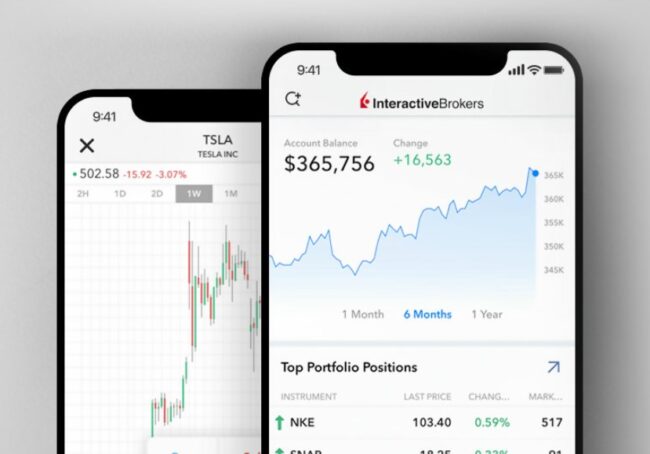

4. Interactive Brokers

If you wish to trade stocks from anywhere in the globe at any time of day or night, Interactive Brokers, which is situated in the United States, maybe the finest stock trading app for you. With access to 125 foreign markets in more than 30 countries utilizing 22 currencies, including stocks, options, futures, and bonds, Interactive Brokers provides what is perhaps the most comprehensive range of international investing possibilities available anywhere in the world.

Aside from that, you may invest in over 8,300 mutual funds without having to pay any transaction costs. If you’re looking into mutual funds, the business will propose ETFs that are comparable but are less expensive. In addition, Interactive Brokers is one of the top platforms in the business when it comes to ordering the execution, actively assisting you in obtaining the best possible price on your transactions.

The company’s entry-level investing plan, known as “IBKR Lite,” provides free trading on domestic equities and exchange-traded funds (ETFs). Additionally, it allows you to trade fractional shares and has a $0 account minimum requirement. As a result, Interactive Brokers is able to compete with the other firms on our list in terms of pricing.

5. Robinhood

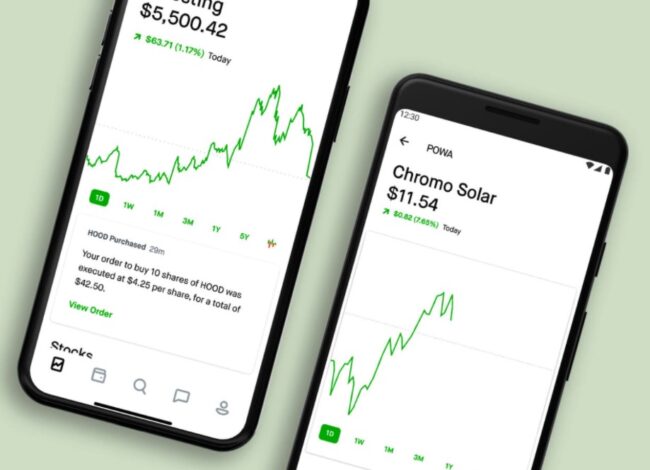

The Robinhood app is the most straightforward, quickest, and most straightforward to use of any investing program I’ve tested. Neither charts nor studies are included, which is a major disappointment. However, if you are a novice investor, it is possible that you will not be seeking for that type of information.

Robinhood provides you with enough information to master the fundamentals of investing and then make transactions quickly and simply – without overwhelming you with information you may not comprehend. Robinhood customers who are well-informed will seek out outside sources for research and analysis, and will mostly utilize the app to manage their portfolios and perform free transactions.

Robinhood is at the very least indirectly responsible for each of the investment applications that provide no commissions on stocks and exchange-traded funds (ETFs) and mutual funds. In keeping with the “move fast and break things” philosophy of Silicon Valley, the firm has been disruptive to the discount brokerage sector, garnering media attention for a combination of innovation and controversy.

Because Robinhood allows you to trade fractional shares, you can build a well-diversified portfolio even if you don’t have a lot of money to start with. It also allows for the exchange of cryptocurrencies. In order to get a foot in the door of the cryptocurrency trading industry, you may start by purchasing as little as $1 in Bitcoin.

6. Schwab

Despite the fact that its website (as well as recent industry media coverage) may give the impression that Schwab is pushing you toward its full service or robo-advisor offerings, self-directed investors still have a home at this traditional brokerage.

The firm has experienced significant changes in the previous two years, including fee reductions and the acquisition of TD Ameritrade in a merger that is expected to be completed within three years.

Schwab, particularly if you use its proprietary StreetSmart Edge software, may be the best location to invest in exchange-traded funds (ETFs), which are a popular low-cost, well-diversified long-term investment strategy. StreetSmart Edge provides more than 150 screening options for exchange-traded funds (ETFs). Schwab customers have access to this sophisticated technology, but non-customers can also take advantage of it.

Schwab also allows you to study equities, exchange-traded funds, and mutual funds all at the same time. Generally speaking, Schwab’s research and investment tools are among the best available in the business. A total of over 500 funds with an expense ratio of 0.50 percent or less are available to consumers through the company’s own proprietary index funds and exchange-traded funds (ETFs).

7. TD Ameritrade

Investors should be aware that Schwab has purchased TD Ameritrade, and that the company will incorporate TD Ameritrade into its operations by the end of 2024. Maintain your caution in light of the fact that it is still unknown exactly what impact this will have on people who invest via TD Ameritrade. In its current form, TD Ameritrade, on the other hand, is the finest stock trading app in 2024, according to several analysts and users alike.

One of the few disadvantages of TD Ameritrade is that it does not allow you to trade fractional shares. Unlike the Robinhood experience, which has little information but is easy to browse, its website provides less information but is difficult to navigate. Customers at TD Ameritrade have access to such a wealth of instructional information (including its own media network), research, and investing tools that it can be difficult to navigate through the maze of options to discover what they are looking for.

Because of its versatility, the platform is a suitable fit for day traders, futures traders, and options traders alike, according to the company. However, it is not specialized. For as long as you adhere to the most fundamental of investment methods, TD Ameritrade should be able to satisfy your requirements.

8. Vanguard

It’s no coincidence that Vanguard has become synonymous with low-cost, long-term investment – and for good reason. It provides a wide variety of proprietary, low-cost mutual funds and exchange-traded funds (ETFs). This is in addition to the more than 3,100 mutual funds that do not charge transaction fees to investors.

According to money guru Clark Howard, if your aim is to follow the kind of long-term investing approach he advocates, Vanguard is well-positioned to help you achieve it. One of the disadvantages of Vanguard is that its tools and data are not quite as comprehensive as those of a couple of the other companies on our list. However, if you are seeking to buy and keep mutual funds, index funds, and exchange-traded funds (ETFs), you will not require those sorts of tools.

It is important to note that if you are a casual investor, you may find the minimum investment requirements to be too high. Vanguard’s robo-advisor service needs a minimum commitment of $50,000. Many of its proprietary funds have investment minimums ranging from $1,000 to $3,000, depending on the fund.

Conclusion

Before you begin investing, be sure that your financial situation is steady and that you have sufficient funds. Maintaining a position in a single company that accounts for more than 10% of your portfolio is not a good idea since it exposes your money to an excessive amount of market risk.

Virtual trading is an excellent way for individuals who want to get their feet wet in the financial markets without putting their own money at risk. It allows you to trade without risking your own money. You may learn the ropes by purchasing and selling virtual shares through several online stockbrokers while getting your feet wet in the stock market.