Cryptocurrencies like Bitcoin, Ethereum, and Ripple are quickly becoming the talk of the town. The global financial crisis has proved that the old banking system is not fit for the 21st century.

Millions of people are looking for alternative ways to save money and secure their assets.

Cryptocurrencies offer a feasible solution to these problems. However, they come with a lot of risks.

If you want to get started but don’t know how to manage your cryptocurrency assets, don’t worry! Cryptocurrencies are here to stay and will only get more popular as time goes on. Read more to understand various ways you can manage your cryptocurrency portfolio to keep it healthy and sustainable:

1. Set Some Goals

First and foremost, it’s important to set some goals. A goal can be anything from a monthly ROI on your portfolio to specific holdings you want to make in the future. Write down what you want out of cryptocurrency and be sure to keep those goals in mind when making investment decisions.

2. Understand the Risks

One of the most important things that you can do is understand the risks. Cryptocurrencies are highly volatile, and there are a lot of risks involved in owning them. It’s not to say that they won’t go up, but one thing you should keep in mind is that they could potentially lose value just as quickly as they appreciated.

It’s also important to note how much risk your portfolio takes on, and try not to overextend yourself in the process. In other words, don’t invest everything into Cryptocurrencies if you don’t want to run the risk of losing it all.

3. Take Advantage of The Benefits

Attracting positive attention is one of the ways to keep your portfolio healthy and sustainable. When you find something exciting, like a cryptocurrency that’s performing well or an ICO that’s generating a lot of buzzes, take advantage of it. Invest in this asset and reap the benefits associated with it.

On the other hand, some Cryptocurrencies are risky investments, so you should be cautious about making any significant investments. You need to balance the risks and rewards as they come up.

If you’re investing in a cryptocurrency that may not perform well or have any potential at all, consider moving on to another option before too much time has passed.

4. Take Advantage of Rebalancing

If you’ve been following cryptocurrency news for a while, you’ll know that the market has been volatile and many coins have experienced major drops in the past year.

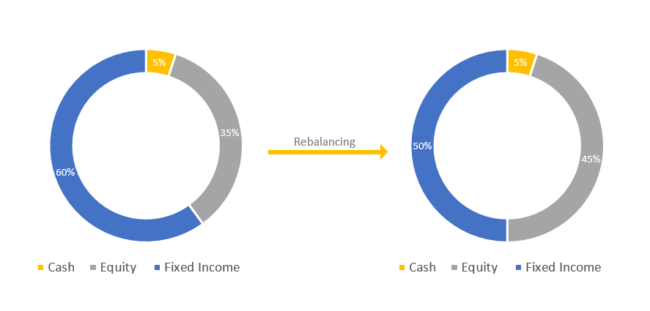

Realizing this, people who want to make sure they don’t lose a lot of money are rebalancing their portfolios regularly. Rebalancing can help you maintain a healthy portfolio even during times when the market is unstable.

The most important thing to remember when it comes to rebalancing is that it should be done regularly. In other words, if your portfolio falls below 45 percent of your total assets, then you should take some money out of high-risk investments and put it into low-risk investments until your portfolio returns to 45 percent or higher.

If you think about it, this strategy makes sense because when your portfolio is at $5 million and the market goes down by 10 percent, what does that mean? You lose $1 million. So keeping your overall percentage of assets at 45 or higher will prevent any major losses in this case.

5. Don’t Keep All Your Eggs in One Basket

You’ve probably heard the term a million times, but it seems to be even truer when it comes to cryptocurrency. Keeping all your eggs in one basket could get you in trouble fast if the market crashes and you lose everything.

To avoid that, diversify. Diversifying means owning multiple Cryptocurrencies so that if one blows up or fails you will still have some money left over. Just remember that diversification isn’t just about how many different currencies you own; it also means owning Cryptocurrencies that complement each other and have similar goals (e.g., privacy coins and utility tokens).

You can also use those coins as collateral for loans or even sell them at a profit to pay off debts.

6. Monitor Your Performance and Learn From Your Mistakes

There are some things that you need to do before you even start investing. First, you need to be aware of the different types of digital assets. You should also know what coin you’re investing in and how it works.

These are both important because they can help you make decisions about which Cryptocurrencies to invest in and what strategies to use when managing your portfolio.

Additionally, it’s important that when you’re trading, you closely monitor your performance and what actions are helping or hurting your investments. You should also always be learning from your mistakes so that this doesn’t happen again.

7. Do Your Homework

Before you jump into Cryptocurrencies, it’s important to do your homework. It’s a good idea to read up on the history of cryptocurrency and how it works. This is important so that you can gain a good understanding of what Cryptocurrencies are about, their purpose, and how they came to be. You should also try looking at other people’s portfolios to get a sense of what has worked for them in the past.

You should also keep an eye on prices over time as they are constantly changing. This will help you understand what the best time is to invest in cryptocurrency. Finally, make sure you check out any tax implications before you dive in headfirst with your investments.

8. Important Cryptocurrency Resources

If you are interested in learning more about Cryptocurrencies and the risks involved, check out these resources.

1. org- Bitcoin is the first cryptocurrency that was created. This site provides valuable information related to Bitcoin and its various features.

2. Coin Market Cap- This website displays a list of Cryptocurrencies including their price, volume, market cap, and more. It is an excellent resource for tracking the performance of your investments.

3. Cryptocurrency Pro- A blog that offers tips and tricks on how to become successful with Cryptocurrencies. The author also provides trading tools that help investors make informed decisions when investing in Cryptocurrencies.

Conclusion

The cryptocurrency market is still in its infancy, which means there are a lot of opportunities to get in on the game. The key to success is being able to manage your cryptocurrency assets efficiently and profitably.