Purchasing a car involves more than just collecting the car you like and then driving it home. It also requires you to find a way to make payments for it. From the perspective of most car buyers, the process involves taking out a loan from a bank or another type of lending institution. You need to check out all of your financing choices before you jump in. The other way around, you might end up paying a low price that will cost you more later on.

When it comes to saving money during an upcoming car purchase, remember that you must do more than simply negotiate a great deal with the salesperson in order to get a better price. Misjudging your car loan may result in costing you both money and wiping out the savings you negotiated on the purchase price. Here in this article, we will highlight some of the mistakes you might do when taking out a loan for your car.

1. Not taking into account the total purchase price

Once you have made the decision to borrow money in order to purchase the car you want, try not to focus solely on the amount you have to pay in monthly repayments. An extended loan duration may reduce your monthly repayments, however, it will also significantly increase the interest and consequently the total amount you will end up paying for the car.

While ensuring whether you will be able to pay and manage to continue with paying the loans you have borrowed is extremely important, plus you need to make an effort to get the best price by haggling. In addition, try to fully understand whatever extra fees you may be asked to pay, for example, stamp taxes or dealer shipping fees.

2. Do not conduct proper research when buying a car

It is impossible to make too much of the importance of getting your research done prior to buying a car or requesting approval for a car loan. Do some research on the type of car you want to purchase first, then seek out guidance. Consider how frequently you will be using the car as well as decide what will be the purpose for its use.

Moreover, you should find out or ask questions regarding fuel economy, dependability, and price. Car review expert sites or other similar trustworthy online sites might be an excellent reference source to get reliable recommendations and help you with your car research. Therefore, if you want to find out more visit ikanobank.dk, you may find your best deals here.

3. You do not shop at more than one lender

Going to just one car dealership is not the way to go when buying a car, as well as you definitely should not go to just one lender when looking to get financing for your vehicle. Luckily, buying from several lenders may be easier compared to buying from many auto dealerships.

It will be a good idea to check out the websites of local banks, large national banks, online banks, finance companies, the financing departments of car manufacturers, and credit unions when sitting in the convenience of your own home.

The process of getting a good loan may be compared to getting a discount on the overall price of the car. Each lender provides different interest rates and loan terms. Also, all lenders probably offer varying standards on down payments, loan-to-value ratios, income limits, and credit score requirements.

4. Not walking away from a crappy deal

One of the most valuable tools a car buyer can have is the awareness of when to step away from a poor deal. Sadly, there are many shoppers who are simply too nervous to stand up and leave due to their worries of being embarrassed or not being prepared to throw away the time they’ve already dedicated to the deal. If you don’t walk away from a poor deal, you are making a mistake that can cost you the duration of the loan – or even more, you may become so entangled in a financing agreement to the point where it damages your credit.

There is no obligation on your part to give a specific reason for leaving. At times, you will be certain you are close to making a bad deal, whereas sometimes you will simply have a gut feeling that you are not being given a fair deal. In that case, you need to follow that gut feeling and ask for a different, better deal or leave. However, never be surprised if the salesperson starts following you, or ends up calling you later on in order to offer you a better deal.

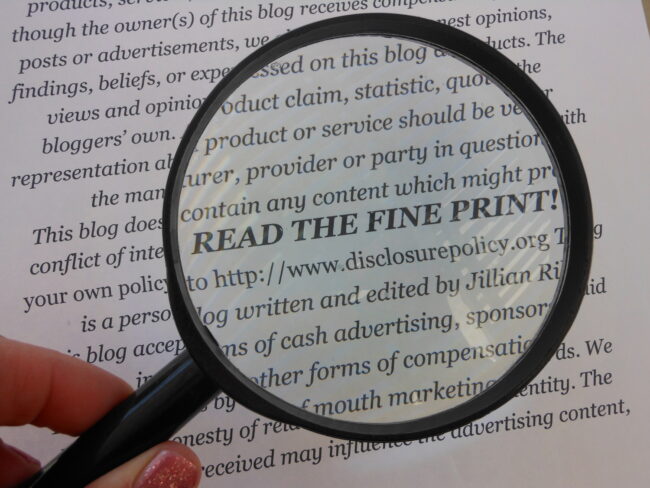

5. Not reading the fine print

The purchase of a used or new car can leave you feeling exhausted. In fact, you will probably just want to hit the road as soon as you’re all set to sign the purchase and loan documents. Sadly, hurrying all the way through the process of filling out paperwork and missing necessary details may actually cost you in the long term. However, one of the very first things you’ll have to do is make sure that the numbers on the paperwork correspond to the deal you’ve both agreed to.

Especially focus on the price of the car, the interest rate, and the term of the loan. When the documents contain blanks or errors, make sure that they are filled out or fixed before you sign. After all, it is nearly impossible to win the argument regarding the errors once you have already signed the papers.

Indeed, the payment needs to suit your budget, however, if you concentrate solely on it, you will possibly end up overpaying. The reason for this is that you may find yourself distracted from paying attention to the overall cost of the car, which includes the price and interest on the loan. Prior to discussing price with a dealer, do some research by visiting multiple local banks, credit unions, and online lenders in order to discover the most competitive rates you might be eligible for and then proceed to try to convince the dealer to give you the best deal.